UK climbs to 4th in league of world’s hottest RE investment spots

Consultancy EY today ranks Britain at fourth place among nations in its influential yearly Renewable Energy Country Attractiveness Index, a rise of one place on 2020.

The government’s new commitment to cutting emissions by 78% on 1990 levels by 2035, reinforcing its pledge to Net Zero by 2050, is a major attraction for inward investors identified by the advisory firm.

So is Whitehall’s forthcoming Net Zero Strategy, promised before the UK hosts CoP26 in November, delivered already rights over six projects in English and Welsh waters drew record prices and unprecedented investor interest, says EY.

The government’s support for funding green technologies, pump-primed with £92m of taxpayers’ cash, plus intended development of the country’s largest battery-storage project, are added positives.

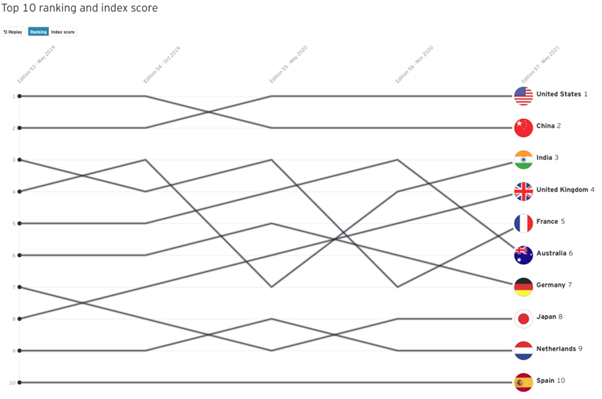

The USA retains last year’s lead in EY’s RECAI poll of investors, analysts and experts, with President Biden’s focus on clean infrastructure and return to the Paris climate goals reassuring investors.

China is second, having invested in 79GW of wind power in 2020. India, on the cusp of an investment boom in solar PV, comes third. Behind the UK come France, Australia and Germany, the latter pair dropping due to policy uncertainties.

Up to $5.2 trillion of additional capital is needed for green investment, EY’s Ben Wood and Arnaud de Giovanni estimate, if the world is to stand any chance of meeting the Paris goals.

New technologies such as green hydrogen, electric surface transport and clean aviation need fostering, just as much as established technologies such as wind and solar.

Wood observed, “Interest in renewable energy has risen among institutional investors, who have pledged to incorporate climate-risk concerns into their decision-making.

“This increasing appetite for suitable investments is driving new investment strategies amongst institutional capital to better align risk and return between sponsors and investors, or to help locate opportunities that satisfy their specific risk and return expectations.”

EY’s full RECAI survey of 40 economies is here.

End.

Green Infrastructure Week curates’ content from the entire ecosystem around green infrastructure from government and NGOs to respected commentators.

Feel free to share this content with your social media community using #GreenInfrastructureWeek

During Green Infrastructure Week we will host a programme of live and exclusive free-to-attend webinars.